Sometimes a stock in your portfolio collects dust. You buy and forget about it. Maybe you skim through the earnings call when they come out, but you don’t put a lot of time into doing actual maintenance work on the name. For me, that forgotten stock is Sportsman’s Warehouse, which I wrote up a year ago. It also happens to be a 10% weighting in the portfolio. With earnings coming out today, it’s probably worth a review.

To start, here’s a broader overview of our original thesis:

SPWH will benefit from rejuvenated interest in hunting and other outdoor recreational activities

SPWH is now the #2 gun seller in the country after Dick’s and Walmart exited the space

SPWH is an orphaned security after its merger with Great American Outdoors fell through, creating an attractive entry point.

You can read more about my original thesis on SPWH here:

Lagging Peers:

Since our purchase, SPWH’s share price has badly lagged its two closest peers (Dicks and Hibbett)

The divergence has occurred for entirely fundamental reasons. While SPWH’s same-store sales have continued to comp negatively, both Dicks and Hibbett have continued to grow1:

It turns out I was right. The pandemic HAS created a secular shift towards more outdoor recreational activity. Dicks and Hibbett have proved that over the last year. I just happened to pick the wrong stock to capitalize on this trend. I rather make money than be right though.

New Growth Algorithm:

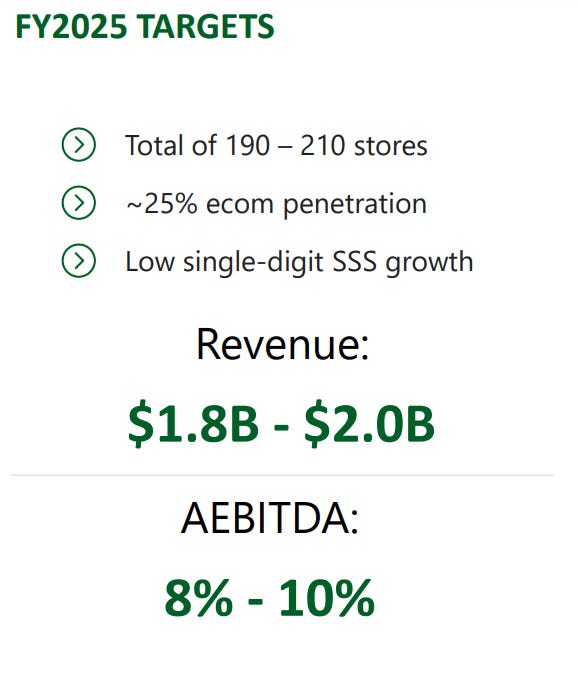

During their September investor’s day, Sportsman Warehouse unveiled a brand new long-term growth algorithm:

Some parts of their long-term goal are realistic. Before the pandemic, SPWH’s adjusted EBITDA margin averaged around 9%, or the midpoint of their guide. Other parts seem aspirational. Management plans to have at least 190 stores by the end of FY25. To reach that benchmark, they need open at least 13 new stores a year. Sounds reasonable right? Except for the fact that Sportsman Warehouse has never opened more than 11 new stores in a single year. Single-digit SSS also seems a bit far-fetched. On the surface, this seems like an achievable hurdle for any retailer. But SPWH’s track record suggests otherwise. Even before COVID, SPWH SSS averaged in the negatives. Part of this is because of the overhang caused by big-box retailers exiting the firearm business. But even with that, SPWH has never proved that their mature stores can organically grow.

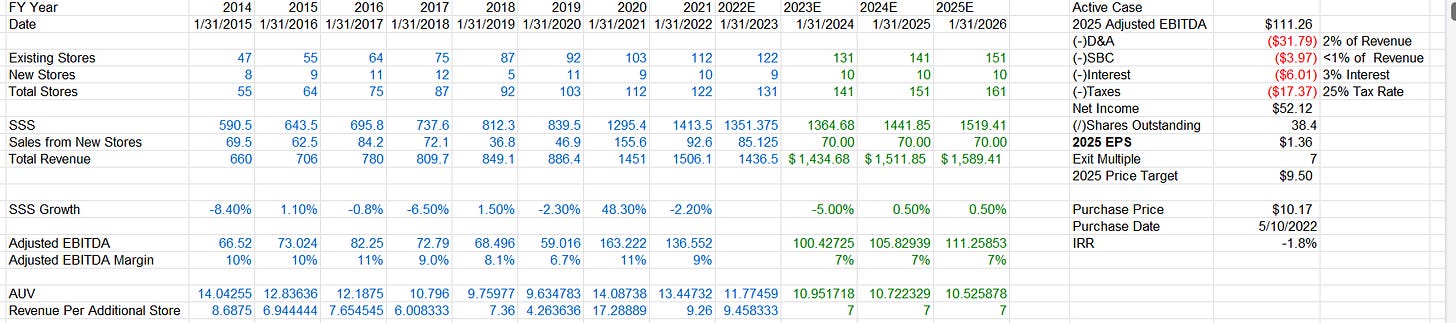

If you take a conservative view of management’s guide, it’s still possible to underwrite an okay return:

My $15 price target, however, is a 25% haircut from my original valuation of $20. The 11.7% IRR is also nowhere as juicy as my 20% projected to return a year earlier.

In my bear case, I took a much more cautious view. I modeled out SSS declining by 5% in 2023, due to macroeconomic weakness. This number is in-line with what happened at Dicks and Hibbett Sporting Goods during the 2008 recession. Then, SSS recovers to only .5% in the next two periods. New store additions are just 10 per year, which is consistent with historical performance. Adjusted EBITDA margin approximates 2019 performance, but is below management’s long-term guide In this scenario, SPWH is worth about a dollar less than we paid for:

Insider Activity:

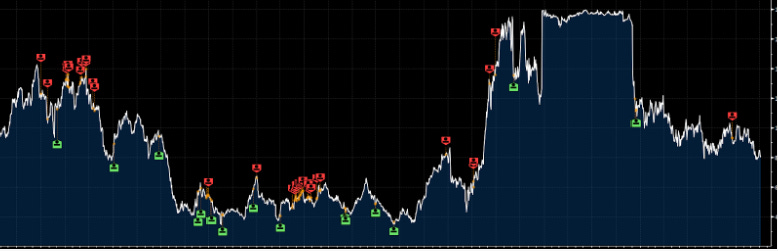

After the merger deal broke, management personally purchased tens of thousands of dollars in the stock. Since then, insiders have turned from net buyers to net sellers of the stock. The most worrying behavior would be from the CEO himself, Jon D. Barker. Over the last two months, Barker cut his personal holdings of SPWH stock by more than a third. Insiders can sell for many reasons. Perhaps Barker was purchasing a new house, paying a tax bill, or making a donation to his alma mater. That being said, the optics of the sales don’t look great. Why would Barker unveil this grand growth plan and then sell a bunch of stock two months later?

Not to mention, SPWH insiders have a nasty habit of top-ticking the stock:

Final Thoughts:

Given my updated projections, I have decided to exit my position completely. My original thesis has either been proved wrong or worsened: Sportsman Warehouse is losing market share to its competitors in the outdoor space. The firearm and ammunition growth rate has returned to pre-pandemic levels. Insiders are now selling the stock. The macroeconomic backdrop has worsened. Most importantly, my projected IRR has collapsed. Based on my current projections, an investment in SPWH will return only slightly more than the S&P 500, with significantly more risk. I just can’t underwrite that bet.

Incremental data points that will make me reconsider my view on the stock:

Same-store sales inflect and are closer in line with Dicks and Hibbett

Management can hit the middle or upper end of their new store additions

Our SPWH trade isn’t a complete wash. I think I’ve learned some pretty important lessons about my investment process here:

Never let a position collect dust in your portfolio. At the very least, you should be performing checkups every 6-months on the names you own.

Don’t just know the company; know the industry. This goes back to one of my broader 2023 investment goals. I want to do more tops-down and thematic research, rather than pure bottoms-up stuff. Not that the latter is a complete waste, but taking a top-down approach is a more contextual and repeatable process. If I did that with the outdoor space, I might have ended up long Hibbett or Dicks instead of SPWH.

At a 10% size, SPWH was too big of a position, to begin with. It was my second-largest weighting, but it wasn’t my second-best idea. It probably wasn’t even my second-best idea of 2022. Nor was it the second least risky idea of 2022. I’ll return to the subject of position sizing later.

I exited our position in SPWH at the market open on 4/12/2023 for $8.77 a share, compared to a purchase price of $10.61. Our investment lost 17% during our holding period, compared to a 7% decline in the S&P 500.

SPWH’s fiscal year ends a month later than DKS and Hibbett’s. This timing discretion means we don’t have a perfect comparison of sales performance between the three companies each quarter. But in the long run, it shouldn’t matter.

Bravo!