Important Note: Portions of this memo have been reused for the USC Stock Pitch Competition. One of the authors of that memo is also the same author of this blog.

Investment Thesis:

FD Technologies’ KX segment is a best-in-class data storage and analytics platform. KX will experience accelerating growth because of increasing AI investment by businesses in the coming years. A recently announced strategic review will further unlock KX’s true value through a sale or spin-off of non-KX assets. Investors have overlooked this opportunity due to FD Technologies’ small size, minimal analyst coverage, and conglomerate holding structure.

Business Overview:

FD Technologies is a mini-European tech conglomerate. They have three operating segments:

First Derivative (58% of sales): A consulting firm that specializes in providing tech support for banks and other financial institutions. Services include designing and building cloud infrastructure, data analysis/engineering, Know-Your-Customer, and other regulatory compliance. First Derivatives has a business relationship with 20 of the biggest banks in the world.

KX (27% of sales): A SAAS platform that provides data management and real-time analytics.

MRP (15% of sales): A B2B marketing technology platform that helps businesses generate and target potential customers.

73.5% of FD Technologies' business is located in the United Kingdom or the Americas, with the rest in Asia or EMEA. The company is listed on the London Stock Exchange, under the ticker symbol AIM: FDP.

Thesis Point 1: A Superior Software Product

FD Technologies KX segment is a best-in-class data storage and analytics SAAS Platform. KX was originally developed for banks and other financial institutions, which was how FD Technologies first became aware of the technology through their First Derivative consulting division. FD Technology would go on to invest in KX in 2014, before buying out the company entirely in 2018.

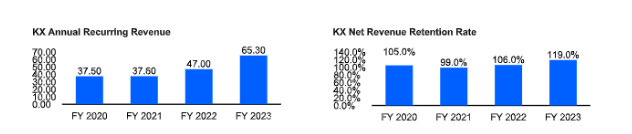

In FY21, KX began to pivot away from a perpetual license agreement with customers to an annual subscription. The strategic shift temporarily depressed ARR as they moved existing customers away from perpetual to annual contracts. Since 2021, ARR has grown at a 20% CAGR, with 38% growth YoY in FY23.

KX differentiates itself from its competitors through its exceptional processing and analytic capabilities. According to third-party reports, KX can process data 100x faster than other competitors at only 1/10th of the computing cost. As a result, businesses generate phenomenal ROI and cost savings when using KX. I believe these cost-savings translate into tremendous untapped pricing power for KX: If enterprises are truly saving millions of dollars a year using KX, then management could easily raise prices 5-10% a year without any customer pushback.

KX also boasts phenomenal customer reviews. On the software review site G2, KX has an average rating of 4.8 out of five stars, with no reviews below a four-star. Here are some of the customer testimonials:

“Streaming analytics, data and analytics in memory, and analysis of historical data on disk in a single solution is unique. KX can do everything another time series database can do but faster and more efficiently ”-Enterprise Service Manager

“KDB core is extremely capable of capturing and processing large volumes of time series data. Even after 20 years, it still produces moments of “wow, that was fast”.-Capital Markets User

“Fundamentally KX core value was always about speed and efficiency…Their focus on speed and minimising space for data is still their edge. They have evolved their tooling to make adoption easier but their underlying power is still their strength.”-Head of Trading Analytics

Over the past two years, KX has announced partnerships with Amazon Web Services and Microsoft Azure. As part of these agreements, KX’s software can be run and be integrated into these company's cloud platforms. AWS and Azure salespersons are also able to sell KX’s software to enterprise customers. Given the size of these sales organizations (10,000+ people), this partnership greatly increases KX’s ability to reach new customers.

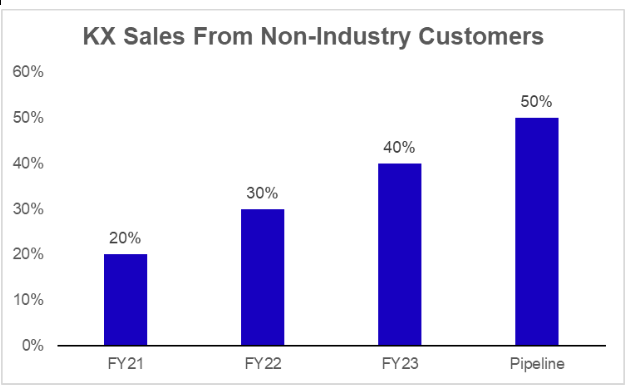

The partnership with AWS and Azure will also accelerate KX’s push into non-financial services. KX was originally developed for capital markets (i.e. trading) and today 60% of revenue comes from financial clients. Over the past few years, management has focused on diversifying the business away into industries like healthcare and industries. In FY23, 40% of KX sales came from these industry customers, compared to 30% in FY22. Today, over 50% of KX’s pipeline is tied to non-financial clients, demonstrating the expanding use case of KX’s software.

Thesis Point 2: An AI Beneficiary

I believe that AI investment will be a significant tailwind for KX’s product offering. Businesses are investing millions of dollars into developing their own AI and large-language models. These artificial intelligence models must be trained on a tremendous amount of data. A good rule of thumb is that if you want to double an AI model’s capabilities, you have to 10x the training data set.

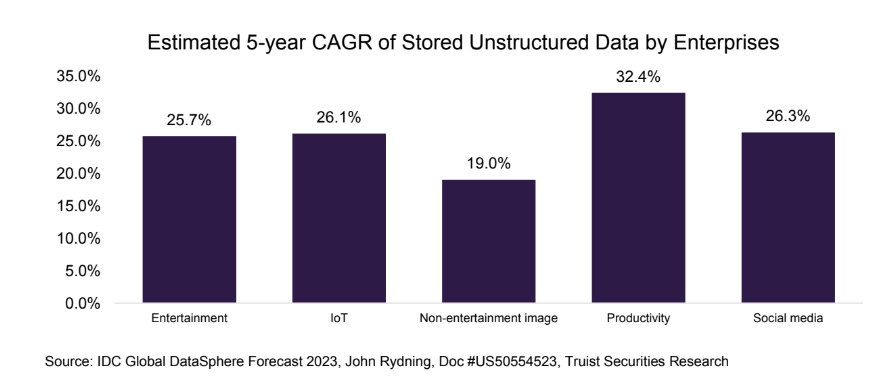

At the same time, the data being used to train AI models is becoming more complex. If you want to teach an AI model to paint a picture or sing a song, it has to be trained on images and audio files, not ones and zeros. This data, also referred to as unstructured data, is inherently more complex. As a result, you have to use more sophisticated databases to house and analyze this data. I believe that KX’s vector database, which specializes in storing and analyzing these intricate data points, is well-positioned to capitalize on this trend. According to Truist, unstructured data is expected to grow at a 26% CAGR over the next five years. Other forms of unstructured data, like productivity data (quality control on car manufacturing, etc.), are expected to grow even faster at a 32.4% CAGR:

Furthermore, other publicly traded database management companies have confirmed that AI has increased demand for their products:

“Generative AI is driving a resurgence of interest in search as customers use semantic search, vector search and hybrid search to ground large language models with their private business context and ESRE provides the most comprehensive and enterprise-ready platform for these use cases. While it will take some time for generative AI spend to become a significant driver of our revenue, we are very excited about the long-term opportunity.”-Ashutosh Kulkarni, Elastic N.V CEO, November 2023 Earnings Call

“One, we fundamentally believe that AI will increase the volume and sophistication of applications being built. There's going to be more software developed. And that's going to mean that there's going to need to be more operational data and more databases backing them. We believe some of the inherent benefits of MongoDB that we just talked about previously, apply even more so to applications powered by AI and automation. And there are a few key components we think are necessary for these modern applications. Vector search being a foundational element. “-Sahir Azam, MongoDB Chief Product Officer, June 2023

“We continue to see demand from customers who are building the next wave of generative AI applications, including AI-powered procurement software, chatbots, coding platforms and even unexpected use cases like predicting and detecting cavities. These organizations turn to Confluent to quickly build and scale GenAI applications that connect their proprietary systems to LLMs, so they can deliver trustworthy and contextually rich insights to their customers. We believe this represents a tremendous opportunity for Confluent as customers evolve from experimentation in the short term to production in the medium and long term.”- Edward Kreps, Cofounder, Chairman & CEO of Confluent, February 2024

Given these tailwinds, I believe that KX can grow ARR at a 45% CAGR over the next three years compared to management’s guide of 35%.

Value Unlock:

On their November 2023 earnings call, FD Technology announced that they were undertaking a strategic review. CEO Seamus Keating cited the following rationale for the review:

“There is a significant sum of the parts valuation discount, and that reflects the different investor appetite for software businesses and for services business.”

I believe this commentary is highly indicative of FD Technologies separating KX from its other two segments. I believe management will announce a sale or spinoff of non-KX assets upon completion of the strategic review in May.

As a standalone company, KX could easily be worth multiples more than FD Technologies' entire current market cap. FD Technologies is currently trading at 1.2x EV/Sales and 13.1x Forward EV/EBITDA. Other publicly traded database SAAS companies currently trade for 13.8x EV/Sales and 115x Forward EV/EBITDA.

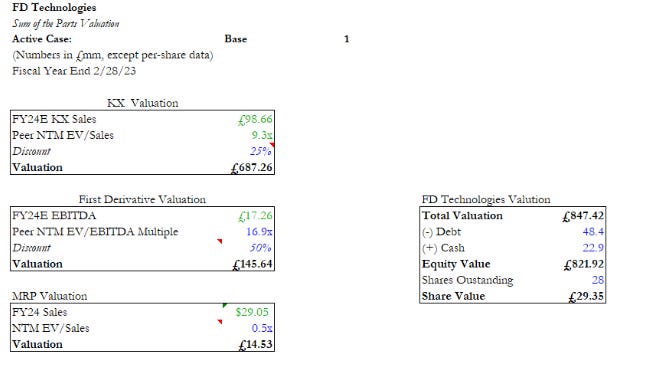

In my base case, I model KX doing ~£98mm in FY2024 sales and value the segment at ~7x NTM EV/Sales, which is a 25% discount to peers. I also model out First Derivative doing £17mm in FY2024 EBITDA and value it at 8x EBITDA, or a 50% discount to peers. Finally, I value MRP at just 0.5x sales.1

In all, I estimate that FD Technologies' three segments have an intrinsic value of £29.55.

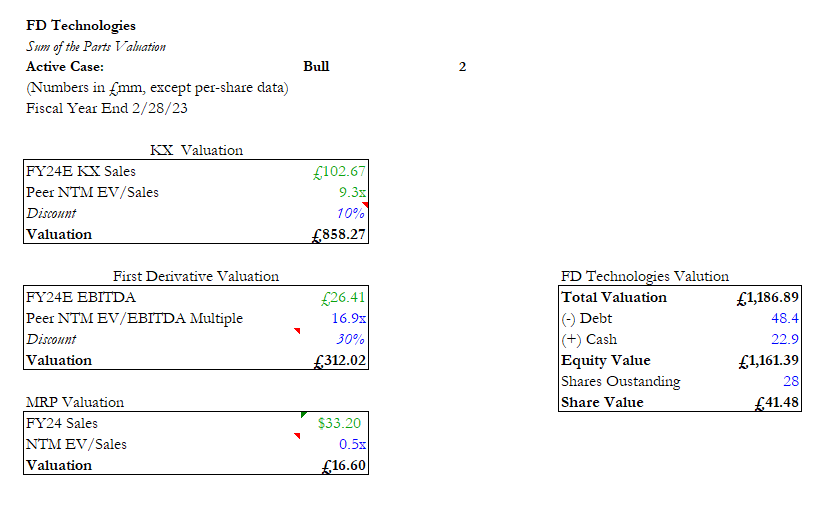

In my bull case, I model out KX doing £102mm in FY24 sales and First Derivative with £26mm in FY24 EBITDA. In this scenario, the valuation discount shrinks to 10% for KX and 30% for First Derivative. I value FD technology at £41.48 a share in this scenario:

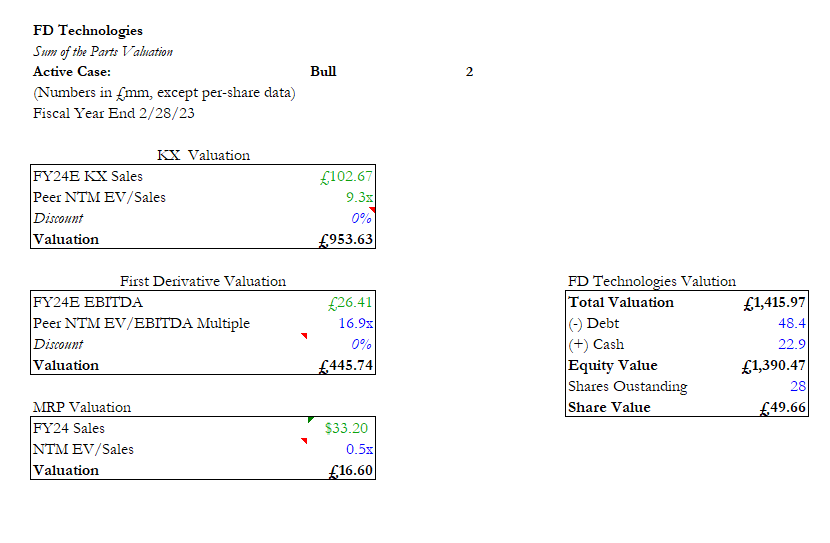

And let's get crazy for this last scenario: what if there is no valuation discount between First Derivative and KX’s peers? Using my bull estimates, I value FDP at £49.66 a share, or 270% upside.

If management doesn’t end up separating the businesses, I assume that FD Technologies will do £344mm in sales and £40mm in free-cash flow in FY26. At 10x EV/FCF, I get to £13.32 in share value, or roughly where the shares are trading today.

It’s important to note this scenario includes draconian assumptions, like KX only growing 30% (500 bps below guidance) and First Derivative EBITDA margins being ~25% lower compared to the last four years.

Risks and Mitigants

IT Spending Slowdown/Recession: A slowdown in the economy or IT spending would dent KX’s growth prospect. KX, however, is benefitting from multiple secular trends, like AI and cloud computing, that will persist in the face of an economic or IT spending downturn.

Competitive Risks: Another SAAS competitor could eat into KX’s market share. KX’s superior storage and processing capabilities protect them from this competitive threat.

Capital Misallocation: Upon completion of the strategic review, FD Technology could fail to separate the KX business from its other two segments. Management, however, cited the valuation mismatch between the two businesses as the reason for initiating the review, making this less likely to happen.

Two-Minute Drill

I’m going to buy $9,000 worth of FD Technologies at this level. I believe this is both a high-quality idea and actionable, with FD Technologies set to finish the strategic process by May. I believe this is a fat pitch, with actionable IRR and little downside, and thus want to be overweight.

My exit plan is to trim, or even sell entirely if FD Technologies fails to announce a separation of the KX unit in May. KX ARR or sales decelerating could also be another breakpoint in my thesis, and warrant a trim of my position.

If you wanted to get creative, you could also short a basket of public data-management SAAS companies ($MDB, $SNOW, $CFLT, etc) to protect against multiple contractions. If I was running a concentrated long-short fund, I would probably put a (cumulative) 50-75 bps short on these names to hedge that risk out. But for various reasons, I don’t short stocks on this blog nor run a long-short fund.

We purchased $9,000 worth of FDP.LN (691 shares) at $13.02 a share.

I’m just not convinced that MRP is a valuable business based on historical performance, hence the low multiple.

Thanks for the writeup. I have some reflections;

1. How do we know that the whole industry is not overvalued due to AI hype and that FDP is correctly valued with its current multiple? IMO, "Company X is trading at multiple A but peers are trading at multiple B, therefore Company X is undervalued" only works if one has understood the full picture. Why is the market pricing it at multiple A, and why are they wrong about it?

2. What exactly is it that makes them stand out compared to peers? "They can process 100x faster at 1/10th cost", but what exactly is this thing that enables this advantage and do they have any patents that protect it?