Hey you! Yes, I’m talking to you. How would you like to buy a near-monopoly with 30% operating margins and projected topline growth of 15% for the foreseeable future trading for just 7x earnings and 7.5 EV/EBITDA?

What’s the catch you say? Well, it’s a former SPAC, with high customer concentration, and it has an obscure cryptocurrency side-project. Oh, and there’s a complicated cap structure.

Hey, don’t click away just yet. I’m just getting started.

Today, I’m going to pitch a long investment in CompoSecure (NYSE: CMPO).

CompoSecure is the leading provider of metal credit cards. CMPO invented the first metal credit in 2003 for American Express. CompoSecure expanded into the commercial market six years later through a partnership with J.P Morgan Chase. Today, CompoSecure is the world's largest manufacturer of these metal credit cards, producing over 30m cards in 2022. Each metal card is sold for $12.5, which is a significant premium to plastic cards ($1.25).

Card issuers are willing to pay a premium for metal as they resonate better with consumers, 74% of all consumers prefer metal cards to plastic ones. 63% of people would be willing to switch banks just to use a metal card.1 Consumers increasingly view credit cards as accessories, not just pieces of plastic. They want their cards to feel personalized—and metal cards enable that experience.

For example, one bank laser-engraved their customer’s personalized signature on metal cards.

The craze for metal cards began in 2016 when Chase launched their Sapphire Reward card. On top of a bevy of rewards, customers gave rave reviews of the card’s sleek metal design. Unboxing videos gardened tens of thousands of views on YouTube. 2

As a result, the Sapphire Reward card quickly became one of Chase’s most profitable cards. One third-party site estimates that Chase earns nearly $400 in pure profit for each card issued.3

The Sapphire’s profitability can be attributed to its high use. Chase’s reward members developed such a cult-like following that members would use it for almost all expenses. This resulted in Chase collecting millions in additional inter-charge fees, on top of interest and other fees.

Everyday card issuers vie to become consumers’ #1 card, resulting in more inter-charge fees. Metal payment cards can further help card issuers win this daily battle. 72% of customers would let metal be their number one card. On a deeper level, metal payment cards “hack” into a consumer’s spending psychology:

“Weight raises customers’ dopamine levels … being able to get into my brain every single time I swipe my card — there’s literally nothing better a marketer could want”- card expert Sean McQuay4

Paying with a metal card also configures a certain level of status. Metal cards are typically reserved for cards designed for higher-income individuals. Thus, paying with metal cards could be seen as a Veblen good--an item purely used to elicit a person’s wealth or status:

“Unlike team-logo cards, though, metal cards aren’t meant to signal fandom or allegiance—they’re meant to signal status, and not just of the airline variety…This is the principle on which the entire high-end-fashion industry is based, and metal cards are maybe most accurately described not as a financial tool, but as a luxury accessory.”-Amanda Mull, The Atlantic5

The growth runway for metal cards is enormous. 4.5B payment cards are issued each year. Currently, just .7%, or 40M, of those are metal. Assuming Composecure can maintain its 75-80% market share, every 100 bps of incremental metal card penetration translates into $400M+ of incremental revenue.

Customer Concentration:

67% of CompoSecure’s revenue comes from two customers: American Express and J.P Morgan Chase.

Normally this is a big red flag. If one customer leaves, revenue will fall 33%, with everything below sales on the income statement declining even more. Nevertheless, I feel comfortable underwriting this risk.

First, CompoSecure has enjoyed a long relationship with both customers. Amex has been a customer for 19 years and Chase for 15. In Q1 2023, American Express recently renewed with Composecure until 2026. Chase is expected to follow later this year.

Second, there are few alternatives, for Amex and Chase. Let me demonstrate this with some back-of-the-envelope math.

In 2022, 40M metal cards were produced. CompoSecure made 30M of these. That leaves 10M in extra capacity.

Assuming stable ASPs between contracts, we can infer Compo made approximately ~10M (.33*30M) cards each for American Express and Chase. With only 10M in excess capacity, there’s barely enough capacity for other metal card manufacturers to absorb Chase or American Express’s pre-existing demand.

Furthermore, the two card issuers would have to source from multiple producers. CMPO management believes they are 8 times larger than the next closest competitor. With 75% of total metal card production (30/40), we estimate the next largest manufacturer makes approximately 3.75M cards ((.75/8)*40=3.75). This means Amex or Chase would have to procure from at least three different manufacturers, if not more.

Given the different manufacturing processes, certain competitors are also not investing in the metal card space.

Here is an excerpt from CPI Payment Group, a plastic card manufacturer on the subject:

“With the metal card segment or heavy cards partaking that. it's not a major revenue source, obviously, for us, but we continue to have some product offerings.

We generate some revenue from that. That is a different line of investment or significant investments that would need to be made and just trying to balance investments with investing in other areas where we've been very successful and also paying down our debt. So it's just a balance that we have to move forward. And we think we've got the right strategies to move forward to continue to profitably gain share”-Q4 2022 CPI Payments Earnings Call

Finally, numerous key Composecure worked in the consumer business for either American Express or Chase. CEO Jon Wilk spent three years working as the Head of Product and Marketing at Chase. Chief Strategy Officer Lewis Rubovitz spent 15 years at American Express, working his way up to VP of Finance in the Global Commercial Payments, Product, and Marketing division. Given this extensive work experience, Composecure’s c-suite likely has a strong pre-existing relationship with managers overseeing Amex and Chase’s metal card business.

Crypto Musings:

One last loose end to tie up: Composecure’s crypto project, Arculus, which is a crypto cold storage wallet.

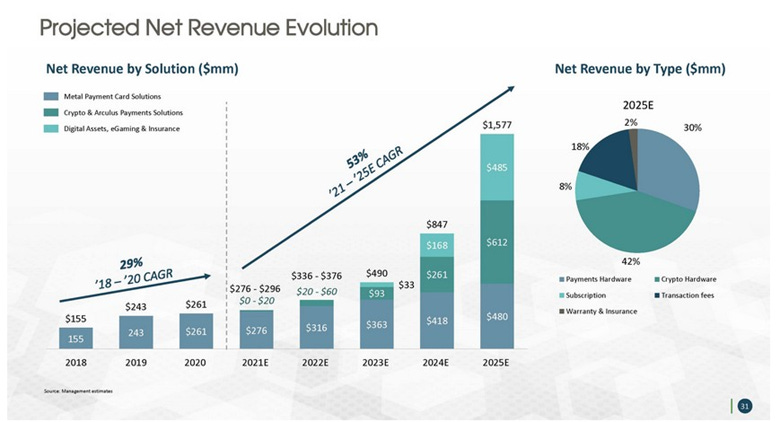

In CMPO’s initial SPAC marketing, the sponsors hyped up Arculus as the main growth driver for the business, while completely ignoring the profitable metal card business:

Composecure’s sponsor, DBRD partners, can be blamed for this poor advertising. I believe much of the skepticism around Composecure can be attributed to Arculus. Investors view the stock as another scummy crypto stock that was a product of the 2020-2021 SPAC boom. When in reality, Composecure is a near monopoly in metal card production with 30% operating margins!

Since going public, DBRD has exited its stake in CMPO. Management has also shown restraint around Arculus. They originally guided Arculus to lose $30-$35M in 2022. When the crypto market thawed and institutional interest dropped, they slashed investment and only lost $20M for the year. For 2023, Arculus is only expected to lose $10M.

And hey, there might actually be real economic value here. Ledger, another crypto cold wallet solution, was valued at $1.5B in 2021. Yes, this was done during peak crypto and the Ledger is likely worth substantially less today. But Ledger does demonstrate that Arculus could have some value. For conservatism, I underwrite Arculus as a complete zero in my valuation —but that doesn’t necessarily mean I’m writing the project off. Like TopGolf’s TopTracer or Travis Matthew, this is another call option that’s immaterial to my thesis but could enhance my returns down the road.

Management:

Despite being a former SPAC, management is not incompetent or generally scummy. CEO Jon Wilk has been with the company since 2017. In his six years at CMPO, he’s more than tripled revenue. Prior to Composecure, Wilk was CEO of Paychoice, which was a SAAS for back-office financials (payroll, taxes, etc) before selling it to PE. As mentioned in the previous section, Wilk also has extensive experience working in marketing for premium customers at Amex. It’s likely through this role that Wilk gained familiarity with CompoSecure’s metal card business and its value proposition.

Management has also demonstrated the ability to play the public markets game. In 2022 alone, they raised annual guidance twice and still hit the upper end of expectations by year-end.

I believe management likely lowballed sales again in 2023. In Q4 2022, CEO Wilks stated he expected the metal cards market to grow at a 15% long-term CAGR. CMPO then issued 2023 guidance of just 9% sales growth. Given recent history, management could be sandbagging again with plans to overdeliver in the second half of the year.

My only quip is with the equity compensation plan. Equity awards are set at laughably low ~$1.5 strike prices. There also isn’t much insider ownership. One of the founders does sit on the board and owns 34.5M Class B shares. But she’s the only significant insider owner. Considering the underlying business and future growth, you would think management would have more skin in the game.

Valuation:

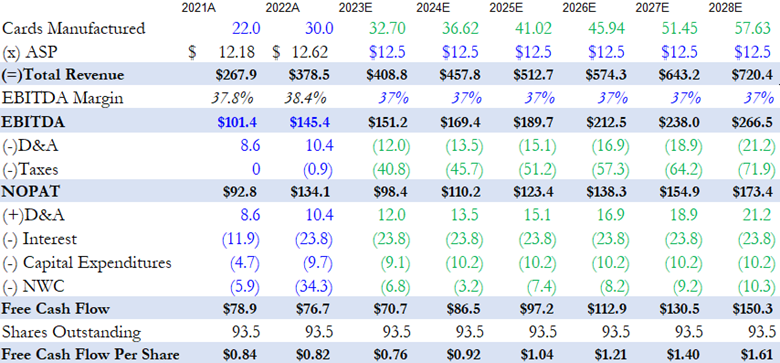

For my financial projections, I estimate that the number of metal cards manufactured will increase by 9% in 2023, in line with management’s guidance. For the next three years, I assume metal card growth will be 12%, which is a quarter below management’s long-term guide of 15%. For further conservatism, I assume there is no change in the ASP of metal cards ($12.5) during the entire forecast period. I assume 37% EBITDA margins, which is about 100 bps less than the previous two years:

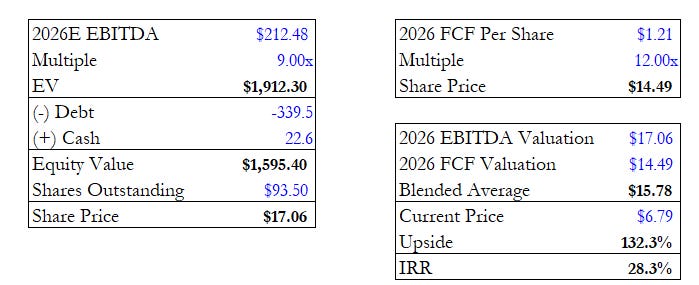

Using my assumptions, 2026 EBITDA comes in at $212M. Using a 9x multiple, I get an enterprise value of $1.9B. Subtracting out debt and adding back cash gets me to a $1.6B in equity value or $17 a share. Using free cash flow for valuation, I get to $14.5 a share valuation.

I took a blended average of these two valuations giving me to a $15.78 target price or 135% upside from current levels. This equates to a 28% IRR!

For a quick sanity check on my 2026 numbers, ABI Research expects 60M metal cards to be manufactured annually by 2026. Assuming CompoSecure maintains their 70-80% market share, then 45M cards produced appear realistic.

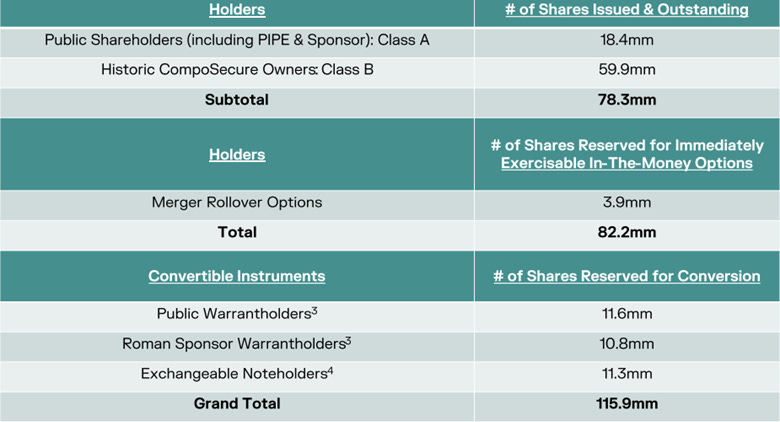

Cap Structure Explained:

As I mentioned at the beginning, CompoSecure has a complicated capital structure.

Here is a snapshot from CMPO’s latest investor presentation:

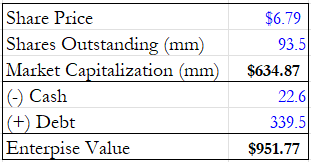

For my valuation, I excluded the Roman and public warrants in shares outstanding. Both warrants are out of the money with a strike price of $11.50. That leaves me with 93.5M shares outstanding.

You may notice my price target of $16, is 45% more than the warrant’s strike price. With a current share price of $6.79, however, CMPO must appreciate 70% before the warrants are “in the money”. Knowing this, I think it's fair to not count in the final count for shares outstanding for the time being.

This is then my current enterprise value:

Now, this isn’t the end of the messy capital structure.

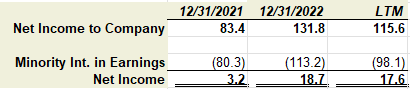

For tax purposes, the insiders who own the Class B shares are taxed as if their stock ownership represents a stake in a partnership. As part of the SPAC agreement, CompoSecure agreed to make tax distributions to these insiders to cover their annual tax payments. This is why the net income available for common shareholders appears so low:

Unfortunately, based on my understanding of the filings, the agreement is indefinite. The Class B shares automatically convert to Class A shares when an insider decides to sell. Over time, distributions should decrease as insiders sell their Class B shares, reducing overall tax liabilities.

Risks:

Customer Concentration Risk: Still a real investment risk, but I feel comfortable underwriting it.

Recession Risk: Card issuers cut back on marketing and other promotional spending during downturns

Manufacturing risk: CompoSecure has one manufacturing plant in New Jersey. If something internal or external happened to the factory, it would be detrimental to CMPO’s business.

We bought 967 shares of Composecure at $6.72 ($6500). My plan is to wait until Chase renews their contract with Composecure before buying more, as it will give me greater visibility on CMPO’s financial performance over the next three years.

https://x.com/seldonofvalue/status/1691155443526025217?s=46

https://www.bloomberg.com/news/features/2016-09-22/how-chase-made-the-perfect-high-for-credit-card-junkies#xj4y

https://www.paymentsjournal.com/metal-cards-in-sync-with-evolving-customer-expectations/

Please Look at My Metal Credit Card - The Atlantic