Thesis:

Enhabit is a classic case of an orphaned spinoff. If all goes well, Joel Greenblatt will write about Enhabit’s success in his next rereleased edition of You Can Be a Stock Market Genius. The home health care provider is well-positioned for the coming “gray” tsunami of elderly baby boomers, and their growing preference to receive care at home. Finally, a rapidly improving labor and regulatory environment will further drive volume growth and market share gain.

Business Overview:

Enhabit is the 4th largest provider of home health services in the United States. The company operates two segments: Home Health and Hospice. The Home Health segment (80% of revenue) provides in-home medical services to patients dealing with chronic diseases or recovering from recent operations across 250 locations in 34 states. They are the #1 or #2 largest home health providers in 11 of those states. The Hospice segment (20% of revenue) provides end-of-life care to patients with terminal conditions across 95 locations in 11 states.

Enhabit differentiates itself from competitors through its low-cost unit economics. According to public filings, Enhabit’s average cost per visit for home health is 15% lower than its larger public peers:

Enhabit achieves these low-cost unit economics through its unique co-location strategy: Placing its home health and hospice units under one roof to provide coverage across one area. As of last quarter, 95 out of 100 hospice locations were co-located with a home health operation. By pairing these segments, Enhabit can streamline nursing utilization and boost referrals. At colocations, Enhabit leverages its scale and density by providing uniform coverage of both home health and hospice patients throughout the day, maximizing its clinical productivity by reducing downtime between visits. The productivity gains lead to higher margins at co-locations. Doctors are also particularly attracted to Enhabit’s colocation strategy, seeing it as a one-stop shop for elderly patients. Home health patients can seamlessly transition to hospice without having to go through the hassle of switching providers, guaranteeing continuity of care and boosting referrals for Enhabit.

Industry Overview:

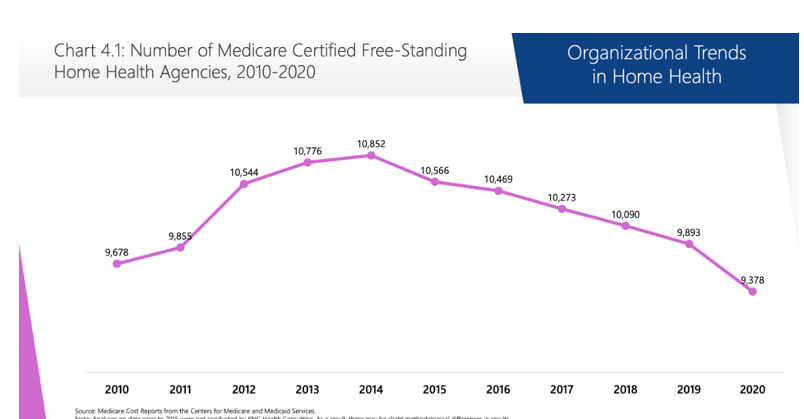

Both home health and the hospice industry are highly fragmented. There are over 9,000 operators in the United States, with 92% of those being mom-and-pop shops (<$5M revenue). However, the number of home health agencies has been declining since 2014:

After a decade of consistent 2% annual rate increases, the CMS took a more austere approach beginning in 2010. Over the next nine years, Medicare cut home health payments by an average of 1% per year. As industry margins collapsed from 19% to 11% over that period, smaller operators without scale were forced to close or were acquired by regional/national players.

In 2020, Medicare transformed the payment landscape even more with the introduction of PDGM. Under PDGM, home health operators would no longer receive a flat fee for each episode. Instead, Medicare would evaluate patients based on clinical chrematistics, admission sources, and timing while also eliminating upfront payments. PDGM’s adoption was expected to further cripple already struggling independent agencies. Instead, the infusion of COVID-relief funds delayed any potential foreclosures. With those funds drying up and sequestration restarting, further industry consolidation and closures by smaller operators are expected to resume in 2023.

Demographic Shift:

Despite these recent headwinds, the home health industry is still projected to grow at a 5-7% CAGR over the next decade. The biggest growth driver will be the coming boom of elderly Baby Boomers. Over the next decade, America is expected to see its population of 75+ and 85+ grow at a 3% and 4% CAGR respectively. The coming grey tsunami will completely transform American society. By 2040, the number of elderly (65+), will outnumber the young (18 and under), by more than four million. As Baby Boomers age, they are also hitting a prime age of needing incremental medical care. With a median age of 65, Boomers have a 70% chance of needing personal care at some point in their life., with that probability only increasing as time goes on.

Increasing Preference for At-Home Care

Multiple factors should increase at-home care utilization in the United States over the next decade. First, consumers have a growing preference to remain homebound. According to surveys, more than three-quarters of Americans fifty and older want to age in their home as long as possible. Americans are also less likely to choose nursing homes for long-term care. The industry’s mismanagement of the pandemic scarred many potential customers and doctors from choosing those facilities, thus expanding home health’s addressable market. Finally, payers are beginning to recognize home health’s value proposition. Not only is receiving care at home cheaper than traditional options, but it also leads to better health outcomes. Over the past few years, health insurers outright have acquired home health companies to capitalize on these benefits: United Health’s purchase of LHC Group last year, Humana’s purchase of Kindred at Home in 2021, etc. Despite these factors, home healthcare is still significantly underpenetrated in the US relative to the OCED, suggesting a long growth runway for the home health industry:

Improving Regulatory and Labor Environment:

If you follow the healthcare industry, you are probably quite familiar with the national nursing shortage that is entering its 3rd year. If you don’t follow the sector here’s a quick rundown: In the early days of the pandemic, rates for contract nurses spiked as healthcare systems were overwhelmed with COVID-19 patients. At one point, contract nurses could make as much as $10,000 a week. Staff nurses began to leave their full-time positions to cash in on these higher rates, putting further strain on the system. Rates for contract labor remain elevated until the summer of 2021. As vaccines rolled out and COVID hospitalization declined, hospital systems weaned themselves off contract labor. The omicron variant completely disrupted this deceleration. While omicron was less deadly than other variants, it was significantly more contagious. Healthcare systems weren’t being overrun with virus hospitalizations like in the early days of the pandemic, but still had staffing constraints as nurses caught COVID and had to quarantine. As a result, nursing costs reaccelerated past their previous pandemic high in Q4 2021 & Q1 2022.

Why does all this even matter? Well, Enhabit is highly sensitive to labor costs. 90% of home health and 60% of hospice COGS are tied directly to nursing costs. Intuitively, the nursing shortage hurt Enhabit’s bottom line: higher nursing costs erode their margins. Less intuitively, the nursing shortage also hurt topline growth. Enhabit simply didn’t have enough nurses on staff to meet demand over the past two years. Both home health and hospice were forced to reject new patient referrals because of staffing constraints. In the short & intermediate term, rejecting patients leads to healthcare providers becoming less likely to recommend Enhabit’s services, hurting future growth.

However, I believe that the worst nursing shortage is behind us. At the very least, Enhabit is improving from the crisis’s peak. Enhabit exited Q1 2022 with 69 labor-constrained home health locations and 20 constrained hospice locations. By the end of Q3, that number had fallen to 41 and 11 respectively. In a December investor’s presentation, management mentioned the need to hire an additional 250 RNs to reach full capacity. Enhabit has averaged ~75 net new nursing hires over the past two quarters. Given this run rate, I estimate that both home health and hospice should reach full clinical capacity by the end of FY2023, or early FY2024 at the latest. Reaching normalized staff levels should enable Enhabit to enjoy the 4-6% organic volume growth it experienced pre-pandemic.

Elsewhere, broader industry commentary seems to confirm my view that labor costs are beginning to normalize:

I think we have a view that as COVID volumes decline and we settle into sort of more of an endemic kind of an environment where there are not these extraordinary opportunities for nurses to chase premium dollars that are 4x or 5x their base salary that we'll see a bit more of a return to historic norms of nurses returning to full-time jobs, et cetera…But I do think those numbers will continue to come down from where they are today to something approaching what we were used to in a pre-pandemic environment.”

– Steve Filton, CFO on UHS 7/26/22 Earnings Call

“Yes, Peter, this is Bill. Let me start first with the contract labor. I think as we discussed last quarter, it was at a peak high in the first quarter really due to the COVID services, and we anticipated to be able to see sequential improvement. And indeed, that's what we saw. We thought it would first start with being able to modify the rates that we were seeing in the market in terms of the average early rate. And indeed, we saw that and we were able to execute on that as the quarter went through. We finished with June at rates we were anticipating when we reset our guidance after quarter. And I think over the course of the year, we'll continue to see hopefully a reduction in the utilization of that contract labor. And again, we were encouraged by the sequential improvement we saw. We're encouraged by kind of how we ended the quarter in the month of June. So it's pretty much in line with what we anticipated.”

- William B. Rutherford Executive VP & CFO on HCA 7/22/22 Earnings Call

“And I think you could legitimately attribute those reductions to the investments we've made, stabilization of the operating environment coming out of the pandemic surges, the recurrent surges and also probably a somewhat less desire for nurses to continue on the pace at which many of them are choosing to travel for other assignments. And I think as all of those things help to stabilize the workforce environment in 2023”

- Saumya Sutaria President, CEO, COO & Director on THC 2/10/23 Earnings Call

Shift to Value-Based Care

In 2018, CMS began experimenting with a home health Value-Based Payment (VBP) system across eight states. Under this payment system, home health care providers with the lowest-cost and highest-quality care began receiving bonus payments. Conversely, providers that were least efficient and had worse patient outcomes were penalized with lower reimbursement rates.

By January 2021, The VBP experiment was hailed as a widespread success. By switching to a value-based system, CMS not only improved patient outcomes but also saved $150M annually in reimbursements. In 2023, VBP rolled out nationwide. For the first two years, the CMS will just collect quality metrics for home health providers, with bonus payments/penalties beginning in 2025. For patient quality, The CMS relies on Quality of Patient Care (QoPC), which is based on a combination of hospitalizations and the risk-adjusted discharge rate.

I believe that Enhabit is well-positioned to benefit from this new payment system. As mentioned in the business overview, Enhabit’s cost per visit is ~15% below the industry average. Do not confuse cutting costs with also skimming on patient outcomes. Enhabit’s Quality of Patient Outcome is 3.7, significantly higher than the national average of 3.3. Furthermore, current equity research reports do not seem to incorporate the impacts of VBP in their models, suggesting market consensus is completely missing the benefit of the shift to value-based care.

Even if Enhabit doesn’t fully reap the benefits of value-based purchasing, the payment shift should at the very least further drive industry consolidation. Like the shift to PDGM, smaller operators are not suited to benefit from this change. Fundamentally, mom-and-pop shops don’t have the scale necessary to keep costs low while also ensuring high-quality patient outcomes. From an operational standpoint, smaller agencies don’t have the resources to best adapt to constantly changing payment rules. The average mom-and-pop is run by a single branch director, who has to work on balancing the books, scheduling RNs, marketing, screening new referrals, etc. Smaller branch directors just don’t have the time to become experts on every updated payment rule. On the other hand, Enhabit has entire teams of employees dedicated to understanding the ever-changing payment rules and then teaching branch directors how to optimize the new system. As one Enhabit Branch director summed it up, “The shift to Value-Based Purchasing will definitely hurt smaller operators.”.

If VBP does drive industry consolidation, Enhabit will be ready for it. Since the spinoff was announced, management has reiterated its plans to spend $50-100M of annual cash flow on acquiring new home health & hospice assets. As VBP puts further stress on independent operators, multiples on these acquisitions should decrease, further increasing Enhabit’s ROIC on these add-ons.

Why This Opportunity Exists:

Enhabit is a classic case of an orphaned spinoff. The company spun out of Encompass at the end of June and fell 50% in its first five weeks. While the stock has recovered some of these losses to start the year, it’s still 35% below its debut price and has underperformed the broader midcap healthcare index by 40% since its debut!

I believe that much of Enhabit’s sell-off occurred for non-fundamental reasons. I estimate that 30% of Encompass’s shareholder base, the parent company, was comprised of mid-cap and dividend funds. At a debut valuation of $1.2B and no future dividend planned, Enhabit shared neither of those traits. As a result, Encompass shareholders became forced sellers of stock upon distribution, creating an attractive entry point for savvy value investors.

Financial Projections:

Given that recruiting for 2024 is right around the corner, I decided to value Enhabit using a DCF for practice. I’m not the biggest fan of using a DCF to guide valuation, but unfortunately proving you know how to navigate one is a significant part of today’s recruiting process. With that being said, here are the assumptions I used:

Before I even tackle the DCF, Let’s break down the revenue and margin assumptions first:

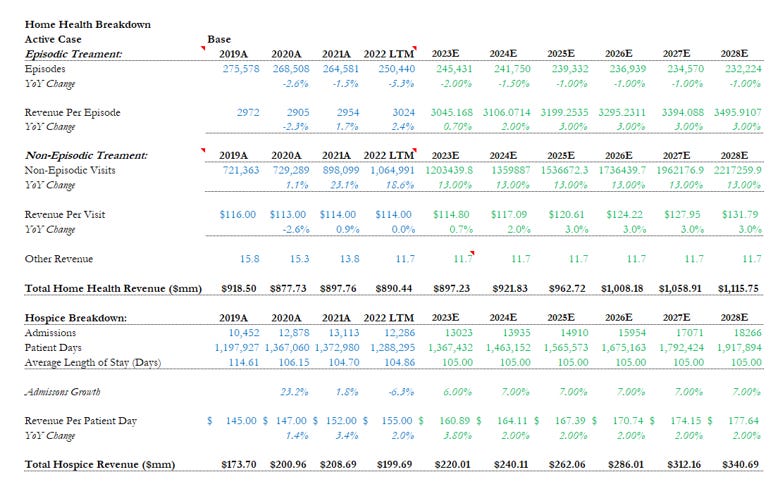

Home Health:

I forecast new episodic episodes declining at -2% and -1.5% in FY23 and FY24 respectively, as the nursing shortage persists and more seniors choose Medicare advantage plans. In FY25 and beyond, I forecast new episodes declining at just 1% per year as Enhabit reaches full clinical capacity. For non-episodic visits, I keep it simple and just straight-lined growth at 13%, which is in line with the 3-year CAGR and the projected growth rate of MA plans.

For revenue per episode/visit, I forecasted FY23 based on the CMS’s .7% increase and FY24 based on the historical average increase. For the next three periods, I project revenue growing at 3% as Medicare begins distributing quality payments for home health providers.

Hospice:

I project hospice admissions growing at 6% in FY23, and then 7% for the rest of the period as staffing constraints end and Enhabit acquires more hospice assets. For revenue per patient day, I forecasted it in line with CMS’s FY 23 update and its historical average of 2%.

Margins:

Gross: In FY23 & FY24, I have COGS hovering around 48% of revenue, which is in-line with the 2020 number. I take that ratio down to 47% in FY25 and beyond as nursing costs decelerate.

Operating Margin: Istraight-linee SD&G expenses at 40% of revenue, which is the current run rate as an independent company.

Plugging my assumptions into my DCF, along with a WACC of 7.4% and PGR of 1%, I get a blended share price of $26.20 or 77.3% from Thursday’s close:

Valuation:

As tends to happen to orphaned spinoffs, Enhabit trades at a significant discount to its peers. Enhabit trades at just 14.4 forward earnings and 9.3 forward EV/EBITDA, compared to the peer average of 20.9 and 13.1 respectively. The discount exists despite Enhabit’s superior operating performance:

Enhabit also trades at a significant discount compared to recent M&A in the home health space. Last year, United Healthcare announced they were acquiring LHC Group, the third largest national home healthcare provider, for $5.5B. From a valuation standpoint, United paid 17X NTM EV/EBITDA and 23x NTM earnings for LHC.

Speaking of acquisitions, Encompass (The Parent) received multiple buyout offers for Enhabit’s home health and hospice assets before the spin. According to Reuters, multiple private equity firms and Avanna Healthcare (NYSE: AVAH) approached Encompass. The opening offer from these two and twenty giants? $3B. As of its last close, Enhabit currently has an enterprise value of $1.2 billion.

Insiders and Potential Activists

Since its July debut, seven different insiders, ranging from board directors to the CEO, have personally purchased shares in Enhabit. Cumulative insider purchases exceed a million dollars. Given the ~50% decline in share price, the large open-market purchases should be seen as a vote of confidence in the business's long-term prospects.

More interesting is a recently disclosed 13-D filing by Jana Partners. The activist hedge fund disclosed a $27,000,000 long position in Enhabit two months ago. Jana Partners is quite familiar with Enhabit. In December 2021, the fund unsuccessfully pushed for Encompass to sell Enhabit, instead of spinning it off. Upon distribution in Q2 2022, I estimate Jana Partners received 1.4 million shares (.5 Enhabit shares for every Encompass share X 2,851,164 shares of Encompass=~1.4M shares of Enhabit) of the newly carved out Enhabit. Here's where things get even more interesting: Instead of selling those shares like the rest of the shareholder base, Jana INCREASED their position to nearly two million shares. Jana has been completely quiet since this was disclosed in their 3rd quarter 13D. They are currently entangled in a much larger activist battle with Freshpet. Previous successful activist campaigns include Blooming Brands, Mercury Systems, and Labcorp. It appears Enhabit could be their next target. As mentioned in the prior section, multiple sources reported that Enhabit’s home health and hospice attracted private bids as high as $3B, or 2.5x the current enterprise value. Knowing this, Enhabit certainly seems ripe for a potential activist like Jana to push for value creation for shareholders.

Risks:

Future Medicare Reimbursement Cuts:

In August, the CMS board proposed a draconian 4.2% cut in home health spending for FY 2023. They also announced that they were repatriating over $2B in home health overpayments from the pandemic. While the home health industry eventually successfully lobbied for a modest .7% increase, the episode represents CMS’s leverage over the industry.

On the other side of Washington, there is significant bipartisan momentum to protect the home health industry from future rate cuts. Following the CMS’s August announcement, Senators Debbie, a Democrat from Michigan, and Senator Collins, a Republican from Maine, introduced the Protect Home Health Act. The bill would prevent CMS from cutting home health payments until 2026 at the earliest. Two more bipartisan sponsors in the House introduced an identical bill. Protecting home health spending seems like a low-hanging bipartisan win. Not only is enhancing entitlement spending protection, but the policy caters to the elderly, a key political constituency.

Even if industry-wide rate cuts did occur, smaller operators would be disproportionately hurt the most by this change. Like the transition to a PDGM payment cycle, subscale home health agencies have less room to cut costs without simultaneously cutting back on patient services. This should drive further industry consolidation, as smaller operators either go under or are acquired by national agencies with scale.

Prolonged Nursing Cost Inflation:

As discussed in the catalyst section, nursing is by far the biggest cost for home health and hospice. If the nursing shortage persisted, then Enhabit’s top and bottom-line growth would continue to sputter. I believe, however, that nursing costs have begun to decelerate. As an indicator of this belief, both publicly traded travel nursing agencies have said that travel rates have declined for the past two quarters:

“In fact, travel bill rates for the third quarter were down 12% sequentially and down nearly 20% since the first quarter, though still 10% higher than a year ago.”- John A. Martin, CEO & President of Cross-Country Health Care.

“So the 25% on the bill rate is off of the first quarter peak and not a year-over-year number. As we look sequentially, we do expect volumes in Nurse and Allied to be up over Q3 and then bill rates down sequentially by approximately mid-single digits. We have seen a flattening in the bill rates since the September time frame. We do anticipate or project that they'll continue to decline towards the end of the quarter.”- Jeffrey R. Knudson CFO, Chief Accounting Officer & Treasurer, AMN Healthcare Services.

While rates are still higher than the pre-pandemic normal, the recent deceleration indicates nursing costs, like the rest of inflation, have likely peaked and are trending towards a more normalized rate.

Increased Telehealth Adoption:

There is some fear that increased use of telehealth will replace the need for an in-person consultation at home. Over the next decade, Telehealth is expected to grow at a 20% CAGR, 2.5x as fast as home health and hospice care. It’s unlikely that telehealth will completely replace the need for in-home services. Patients with chronic or terminal conditions will always need medical treatment from an actual person, and not through a computer screen.

In the end, telehealth may prove to be an accelerant of home health adoption. Technology that brings the doctor to a patient’s home should normalize receiving care at home, increasing home health’s TAM.

With all said and done, I’m going to buy $8,000 worth of Enhabit for the portfolio at these levels. My cost basis is $14.73.

Note: Some parts of this write-up may have been reused from my Notre Dame Stock Pitch Competition memo and presentation.