Enhabit Update

What do you get when you combine industry M&A activity and operational mismanagement? A prime activist target.

At the end of my original Enhabit, I alluded to the company becoming a potential activist target:

“More interesting is a recently disclosed 13-D filing by Jana Partners. The activist hedge fund disclosed a $27M long position in Enhabit two months ago. Jana Partners is quite familiar with Enhabit. In December 2021, the fund unsuccessfully pushed for Encompass to sell Enhabit instead of spinning it off…….As mentioned in prior sections, multiple sources reported that Enhabit’s home health and hospice assets attracted private bids as high as $3B, or 2.5x current enterprise value. Knowing this, Enhabit certainty seems ripe for a potential activist like Jana to push for value creation for shareholders.”

I wrote that five months ago. Let’s run through everything that has happened since then:

2/15/23: Enhabit reports fourth-quarter earnings after market close. The stock pops but gives up all those gains and then some as the week goes on.

3/30/23: Enhabit reaches an agreement with Harbor Point Capital and Cruiser Capital. Collectively, the two funds own 4.7% of the shares outstanding. Enhabit adds two temporary board members nominated by Harbor Point and Cruiser as part of the agreement.

4/3/2023: Enhabit announces that their first 10-K as a publicly traded company will be late, due to accounting issues with their goodwill and account receivables calculations. Surprisingly, the stock moves little on the news.

5/1/2023: Enhabit files their amended Fiscal Year 2022 10-K.

5/3/2023: Amedisys, the second largest home health operator in the US, announces a merger with Option Care Health, valuing Amedisys at $97 per share or $3.6B. The deal will be done through a combination of Option Care stock and cash, pending shareholder approval. The following day, Amedysis stock slightly gains on the news; Option Care stock plummets 25%.

5/10/23: Enhabit reports disappointing 1st quarter earnings. The stock falls 9% the next day.

6/6/23: United Health launches a counterbid for Amedysis. The $100 per share bid is only a slight premium to Option Care’s original bid of $97. But United Health’s bid is in all cash, a much more attractive offer for Amedysis shareholders.

6/13/23: AREX Capital Management issues a scathing letter to Enhabit. The activist hedge fund, which owns ~4.5% of shares, accuses management of numerous self-inflicted operational missteps since going public and pushes the company to sell itself to maximize shareholder value. The letter also reveals Enhabit is currently interviewing two more additional board members recommended by AREX.

6/26/23: Amedysis accepts United Health’s unsolicited bid of $101 per share.

6/30/23: The CMS publishes its initial 2024 home health spending recommendation, which includes a 2.2% cut in spending. Enhabit stock falls 8% on the news but has since recovered all of its losses.

Whew. That’s a lot of news in 5-months.

In some sense, I was half right in my assessment of Enhabit. Yes, they were prime for an activist, but Jana isn’t the fund leading the charge. By my count, approximately 14% of the shares today are held by four activist funds. Together, they’re on pace to control four board seats.

Regardless, there’s a lot to unpack here. I’m going to start with the most recent activist letter. You can read the entire letter here, but I’m going to focus on the most important takeaways.

Like many other activist crusades, AREX accuses management of numerous operational missteps since going public. Furthermore, the letter warns that Enhabit’s issues could cause investors to permanently put the stock in the “penalty box”.

For AREX the solution is simple: Enhabit must sell itself to maximize shareholder value:

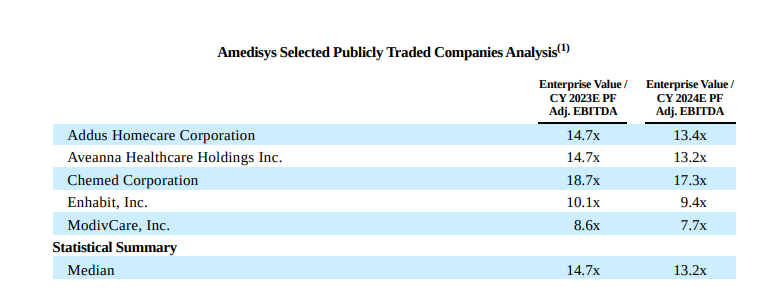

“The recent M&A activity among Enhabit’s peers illustrates the enormous potential returns to shareholders if Enhabit were to pursue a sale. Just over a year ago, in March 2022, UnitedHealth paid ~21x NTM EBITDA for LHC Group. And over the past two months, both Option Care Health (in stock) and UnitedHealth (in cash) have offered to buy Amedisys for ~15x NTM EBITDA. Applying those multiples to consensus NTM EBITDA forecasts for Enhabit yields a potential sale price range of $30-40 per share, more than triple Enhabit's current share price at the high end of the range”

I do believe AREX is being a bit generous when it comes to their exit multiple. Looking through Amedysis’s proxy filing, A fair price for Enhabit is closer to 12-13x NTM EBITDA, not 15-21x:

Applying a 12.5x multiple on Enhabit’s 2024 EBITDA ($130m according to Bloomberg) gets me to ~$21 in equity value or 50% upside.

But if Enhabit is going to be sold, who’s the strategic buyer?

This is where the Amedysis deal comes into consideration. With United Health acquiring Amedysis, the insurer has 10% of the US home health market. That’s almost double the size of the next closest competitor, Kindred at Home. Obviously, the acquisition still needs approval from the hawkish FTC. But if United Health’s bid gets approved, the insurer would have a significant size advantage in the home health market along with rapidly accelerating the pace of industry consolidation.

This leads me to believe that an acquirer of Enhabit would already have significant home health operations. Using these criteria eliminates private equity or a smaller insurer, like Cigna, from the buyer's universe. This gives me two logical acquirers.

First, we have Humana Health. In 2018, the insurer, along with a consortium of private equity firms, acquired Kindred Health for $8B. Since then, Kindred has grown to the largest home healthcare provider in the United States, with a 6% market share. Acquiring Enhabit would further boost Kindred’s market share to 10%, rivaling United Health’s potential scale. Humana also has $13B of cash on hand, so financing wouldn’t be an issue.

Secondly, we have April Anthony’s Vitalcaring, a privately held home health business. Anthony is actually the founder and former CEO of Enhabit. Anthony left Encompass in 2021 and would start Vitalcaring shortly after her departure. Encompass (Enhabit’s parent at the time) would later accuse Anthony of violating her non-compete, resulting in a long legal fight.

As the AREX letter pointed out, prior to her departure, Anthony actually tried to acquire Enhabit for $3.6B. That same offer today would yield a share price of about $60!

The biggest question for Vitalcaring is financing. Since it's privately held, we have no visibility on the company’s financial health. Vitalcaring is also smaller than Enhabit, with only 75 locations as of writing. Any deal with Enhabit would be more a merger of equals, rather than Enhabit being swallowed by a larger competitor.

Insider Incentives: Do We Have a Motivated Seller?

Finally, I think examining executive incentives in these types of situations is crucial.

Current CEO, Barbara Jacobsmeyer, owns about 550,000 shares and another 300,000 options that are vastly out of the money:

On top of all these options, Jacobsymer was also granted a “founders award” at the time of the spinoff. According to the proxy, Jacobsmyer received another $3M in stock options which were priced based on Enhabit’s debut price (~$25). I estimate this works out to be another 120,000 shares, bringing the grand total to just under a million shares of total ownership.

Jacobsymer is in line for a massive payday if she can sell Enhabit. If Enhabit is sold for $25 a share, Jacobsmeyer stands to make ~$14.7M. If Enhabit is sold for $30 a share, that payout jumps to ~$21M. If Enhabit is sold for $35, Jacobsmeyer could make $25M! For a person making $800K in base salary, any of these purchasing prices results in a fantastic payout. Furthermore, Given the fact that Enhabit stock is down 60% from its highs, selling the company is arguably the “quickest” route to Jacobsymer getting paid.

Final Considerations:

With a renewed activist push and industry consolidation tailwinds, I believe there’s a ~75% chance Enhabit gets bought out over the next two years.

It’s important to note there are massive tax penalties for an acquirer if a spinoff is purchased less than two years after going public. This means Enhabit can’t be sold until June 2024. In the near term, this tax nuance prevents Enhabit from immediately selling itself. In the medium term, the delay diminishes our IRR.

At 8%, Enhabit is already a pretty full position. My current plan of action is to add another 1 or 2% ($1000-$2000) if a strategic review is announced.

-Seldon.

What do you think of the revised guidance for rest of 2023 will do in terms of buy price? My new estimate is around $19.08/share as opposed to this Friday's close of $11.5/share. I currently don't have a position but would be tempted to enter at $11/share. Great writeup!