Thesis:

We believe that Capri Holdings is one of the most fundamentally misunderstood stocks on the market. The company is currently in middle to late innings of its turnaround from a floundering discount retailer to an international luxury powerhouse. Despite investing in the late stages of this transformation, the stock trades at a level offering extremely asymmetric risk-adjust returns. With accelerated capital returns paired with fast growing bottom and toplines, you don’t have to make wild assumptions for the investment to return 3-4x over the next 3-5 years.

Business Overview:

Capri Holdings is a international global luxury brand that sells under three distinct brands:

Michael Kors (72% of Revenue, 85% of Operating Income):

Michael Kors is the original business of Capri Holdings. The company markets itself as an “affordable luxury” brand, selling footwear, clothing, accessories along with watches and other jewelry. It sells their products through their retail and outlet stores, and through wholesalers. Capri’s long-term goal for the company is $5 billion in sales paired with 25% operating margins.

Jimmy Choo (10% of sales, 1% of operating income)

Jimmy Choo is a luxury women’s footwear and accessories company. Kors purchased Jimmy Choo in July 2017 for $1.2 billion, outbidding Tiffany’s and Kering. Capri’s long-term goal for the brand is $1 billion in revenue and 15% operating margins. Management plans to achieve this goal by growing higher-margin accessories to 50% of sales, adding a hundred new stores, and increasing penetration in Asia.

Versace: (18% of sales, 14% of operating income)

Versace is a luxury lifestyles brand that sells clothing, accessories, footwear, and fragrance. Management is targeting $2 billion in revenue and 20% operating margins in the long term for Versace. They want to achieve this goal by increasing accessory penetration, improving existing store productivity, and growing the brand in Americas and Asia.

Turnaround Story.

In 2017, Michael Kors began the transition from “affordable luxury” to premier luxury. In the prior years, the company had lost control of its brand image. Wholesalers would heavily discount their products, which would dilute the luxury appeal of them. Kor’s retail and outlet stores also began to lose market share to other luxury brands and e-commerce. In 2017, John Idol began a multi-step multiyear turnaround plan for company. Kor’s began to scale back on its distribution to wholesalers, so that it could exercise more control over the brand. Idol and CFO Tom Edwards also embarked on a retail optimization plan. They began to close unprofitable stores, reduced SKU by 30%, and raised prices on products that were more in-line with luxury peers.

The second step of Capri’s pivot into premier luxury involved acquiring legacy luxury brands. In 2018, Capri acquired Jimmy Choo, a luxury designer shoe brand, for $2.1 billion. The following year, Capri purchased luxury lifestyle brand Versace for $1.8 billion. Both brands were turnarounds in themselves.

From the very beginning of these turnarounds, John Idol has expressed the need for long-term investment to succeed in luxury. Idol, and his CFO Tom Edwards, believed that you need to take a 10 year view to succeed in luxury. This meant ramping up investments in both Versace and Jimmy Choo, even if that meant sacrificing short-term operating margins Jimmy Choo invested in growing its store base from 200 to 300. Management also overhauled their product offerings, adding emphasis on higher-margin accessories, like handbags. After acquiring Versace, Idol and Edwards shut down two of the four lines of business. They have used capital expenditures to modernize their stores and improve overall productivity. Idol also took a page from the Michael Kors playbook and raised prices on products across the two brands to a level more in-line with other luxury peers.

Fiscal 2021 (June 2020-June 2021) was supposed to be the inflection point for both brands. Covid had other plans(I’m sure you can figure out the rest). Luckily, luxury rebounded strong in the second half of the year as stimulus began and the economy reopened. Today, spending across all brands has still surpassed 2019 levels, despite less stimulus, inflation, and supply-chain issues.

Why does this opportunity exist?

From a market-wide perspective, there has been a severe selloff in low-quality retail names due to recession fears and inventory buildup. I believe that Capri is a baby being thrown out with the bath water in this instance. First, luxury brands are extremely resilient to any economic downturns. In 2008, Capri actually grew sales through the downturn. Furthermore, luxury spending continues to comp at 20-30%+ pre-pandemic levels, despite laps in stimulus. I believe the brands will hold up just well in any recession.

In terms of inventory build-up, it’s important to note that most of the inventory listed on the balance is just in-transit, and not sitting around in stores waiting to be bought. My channel checks have indicated that stores have had no problem getting rid of inventory, even at higher price points.

A better explanation for the discount can be found in the C-suite. In August of 2021, John D. Idol announced he would be stepping aside as a CEO of Capri after 18 years. Idol would remain Chairman of the company and named Josh Schulman as his successor. In March 2022, Schulman suddenly announced his departure from the company, effective immediately. The stock proceeded to lose 20% of its value over the next few sessions and has remained lower ever since.

I think the market is vastly overreacting to this executive drama. John D. Idol has agreed to return as CEO in the interim. Idol has been a great CEO for the company, executing its turnaround from affordable luxury to premium brand. Idol is partnered with a fantastic CFO in Thomas Edwards, who is a straight shooter and provides excellent detailed commentary and guidance for the company. Furthermore, Idol has 90% of his net worth in common stock. He is clearly aligned with shareholders and should continue to behave so.

Margin Upside:

Management has consistently under promise and over delivered when it came to giving margin guidance for its three brands. In FY 2019, they targeted 20% long-term operating margins for Michael Kors. The following year they raised their long-term guidance to 25%. When they first acquired Jimmy Choo in 2018, they believed that low teens EBIT margin was a feasible end goal. Over the last few years, they have raised their expectation to 15% for the brand. After purchasing Versace, management targeted EBIT margins in the mi-dteens. Today, they believe Versace will end up doing 20% margins in the long run. Much of this margin improvement can be attributed to higher sell through prices across all three brands. I believe that Capri has considerable pricing power as it continues its pivot to premium luxury, which should continue to drive higher margins over the next few years.

Furthermore, Capri’s long-term company goal of 20% EBIT margin at the company wide level still undershoots other luxury peers. LVMH and Kering both have operating margins close to 30%. If Capri can continue to raise prices to a similar price point as other luxury brands, a similar margin profile is certainly in reach.

Accelerated Capital Returns:

Over the last five years, Capri has spent ~$3.4 billion on acquiring Jimmy Choo and Verscae. It spent another ~$750 million on capital expenditures and paid down $800 million in debt over the same period. At the end of day, there wasn’t much cash flow left over for share repurchases or dividends. The shares that were purchased during time simply offset the dilutive nature of the acquisitions and SBC.

Today, I believe company is on the cusp of a significant capital return. $CPRI is currently trading at just 10x earnings and 12x cash flow, a deep discount to other luxury peers. Idol and Edwards are smart enough to recognize this discrepancy. They’re even smarter in knowing how to close the gap. Here’s what John Idol said last month:

““And we believe that there is tremendous upside for us to acquire our own company and again, it's a personal opinion, but what we think are significantly undervalued multiples of our company today. So to me, that's the best acquisition we can make right now is in our own company, especially these multiples”-John D. Idol, CEO & Executive Chairman, 2022 Investor’s day

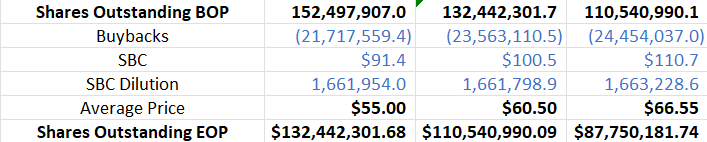

In June, the company announced a $1 billion buyback program. This is the largest share repurchase in Capri’s history. But I think they could easily do at least a billion dollars annually in share repurchases, if not more, over the next the three years.

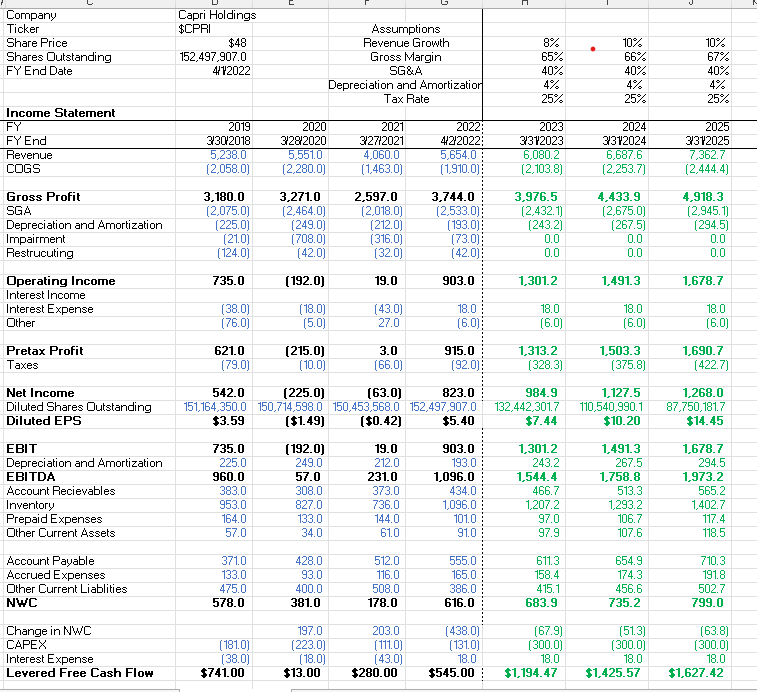

Here are my projected financials for the company:

Using my assumptions, the company will generate more than $5 billion in levered free cash flow over the next three years. if they spend all of this cash flow on repurchasing shares, they could easily retire 1/3 of the float.

Yes, these are extremely aggressive assumptions. But management tends to go big with capital allocation when push comes to shove. They outbid Kering and Tiffany in 2018 for Versace, along with beating Coach and private equity for Jimmy Choo in 2017.In both instances, they weren’t the biggest dog in the fight, but they weren’t afraid of using their teeth. No matter the stakes, John Idol and Thomas Edwards are not afraid of shoving all their chips in the middle when they sense opportunity. If they truly believe CPRI is undervalued as they say it is, I expect them to repurchase shares at a rapid rate. Applying a 15x earnings multiple to FY 2025 EPS projection of $14.45, I get a share value of $216, or four times the company’s current values. I’m going purchase $9,500 at these levels.