During Capri’s FY23 2nd quarter earnings call, management tampered their full-year guidance. In response, I wrote this during my earnings review in November:

“Capri management also has the virtuous habit of underpromising and overdelivering, as I mentioned in my original writeup. They much rather disappoint on guidance and easily beat, than the other way around. In the past 4 quarters, they have beaten EPS estimates by an average of ~20%! Like I said, they have a habit of unpromising followed by overdelivering.

Given management’s historical caution when it comes to giving guidance, I am willing to give management the benefit of doubt. “

I was wrong. I mistook Capri’s guide for being conservative. It should have served as a warning.

On February 2nd, Capri reported their FY23 Q3 results. The print was less than spectacular, to say the least. Total sales declined by 6.6% YoY. Despite the holiday season, all three brands reported lower revenue than a year ago. Operating margins for the quarter fell 500 basis points to 15.61%. Earnings per share were $1.84, compared to consensus estimates of $2.24. This was the first time Capri failed to beat earnings estimates in over five quarters. In the following trading session, Shares in the luxury retailer collapsed from $63 to $48. They have since drifted even lower to $41, falling below our purchase price of $48.

Breaking it down by segment, Versace reported a 1% decline in sales, but up 11% on a constant currency basis. Versace’s operating margin also declined to 15.7% compared to 12.7% in the prior year.

Jimmy Choo’s sales fell 6% year over year but increased 3% on a constant currency basis. Excluding Chia, sales were up 11%. Jimmy Choo was the only brand to see its operating margin expand YoY, increasing from 9% to 10.7%.

Michael Kors, Capri’s cash cow, had the worse performance of the three brands. Revenue decreased by 6%, and 3% on the same currency basis. Sales in the wholesale channel fell 25% YoY. Operating margins collapsed 540 basis points to 22.9%, compared to 28.4% the prior year.

Despite Capri’s abysmal quarter, I believe that temporary industry headwinds were the main culprit behind their poor performance. A weak wholesale channel and dampened Chinese demand were the two biggest challenges for the quarter. Across all three brands, wholesale sales fell 20%. For wholesale, the perfect storm of factors contributed to its lackluster quarter. Persistent inflation ate into consumers’ discretionary holiday spending. Retailers were also overstocked with inventory from the previous quarters, reducing the need to make additional purchases from Capri. Given these supply and demand factors, the wholesale channel wasn’t primed for success.

It would be wrong to refer to these as one-time events. Instead, this is just another part of the inventory cycle: Consumers demand more of a particular item, retailers and wholesales order more of such good, new inventory eventually outpaces demand, retailers are then left with unwanted merchandise and begin discounting the item to move it off their shelves, inventory levels stabilize relative to demand, and then the cycle starts all over again.

The last two years accelerated and heightened this cycle. After lockdowns were eased, Capri quickly realized they didn’t have enough inventory to meet pent-up demand. New orders were placed but were delayed due to supply-chain woes. When new inventory did arrive, demand had significantly weakened, leaving Capri now with too much inventory across their retail and wholesale channels. I believe we are rapidly approaching the bottom of this inventory cycle, which I further highlight in the later inventory section.

Looking across the Pacific, China’s reopening didn’t do Capri any favors either. Revenue fell nearly 40% in the country, as a surge of COVID-19 cases sent millions of residents into further quarantine or lockdown. But just like wholesale, this appears to be a temporary issue. After three years of their draconian Zero-Covid policy, it is not surprising that cases spiked after restrictions were lifted. Catching Covid at this point isn’t avoidable, it can only be delayed. And Chinese citizens are just now paying that price. But the good news is China is committed to reopening the country. Citizens will get sick as restrictions are lifted, which will put them back in quarantine. Unlike the previous two years, however, restrictions are being eased even as cases rise. For the first time since 2020, we have clear visibility about when China will return to normal pre-pandemic life. The Chinese consumer should return to normal in the latter half of 2023, boosting luxury spending in the country.

Inventory:

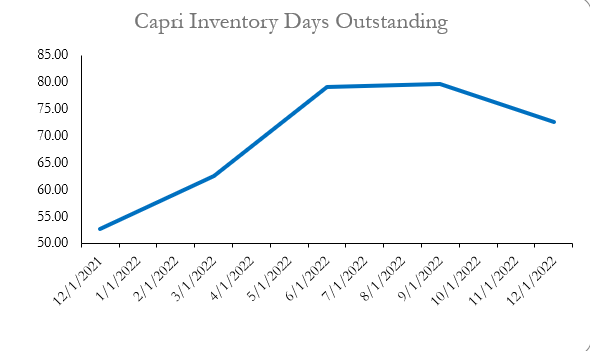

In my previous write-up, I highlighted how Capri’s inventory buildup was the biggest near-term risk to my original thesis. Well, this was the first quarter in a year there was a marginal improvement in Capri’s excess inventory: Inventory days outstanding fell from 78 to 72 days sequentially.

Management also indicated that they were beginning to manage inventory better in light of the recent demand pullback:

“We had anticipated a sequential improvement at POS during the holiday shopping season, but that did not materialize. Therefore, we shipped less into the channel as we did not want to end up with excess inventory,”-John D. Idol, CEO

Unlike other retailers, Capri isn’t engaging in cutthroat discounting to move inventory off the shelves. Instead, management is pushing pause on price hikes for their three brands:

“We told you either 2 calls ago or last call, we are not going to be taking any more price increases. There's a little bit of it that will flow through in the first half of the year. And then we're stopping the price increases across the group. For the time being, we're going to take a pause. We also took fairly significant price increases at Jimmy Choo and Versace as well. So we think we're in a good place in terms of where our pricing is right now.” -John D. Idol, CEO

To me, this shows that Capri’s transformation into a luxury brand was successful. Discounting products completely dilutes a luxury brand’s appeal. If Capri was just another Under Armor or American Eagle, they would be heavily discounting their excess inventory to move it off their shelves. Instead, they’re remaining disciplined in their luxury strategy. Capri’s strategy will weigh on near-term earnings. In the long run, Capri’s disciplined approach is the right move as they’ll preserve the luxury image they’ve spent the last five years cultivating.

Shareholder Returns:

For the quarter, shares outstanding fell 9M to ~128M sequentially:

Capri has repurchased an additional 3M shares in 2023. Since Capri began their repurchasing regime in FY Q2 2021, they have already bought over 27M shares out of 155M shares outstanding. In other words, management has increased the long-term earnings power of the business by 17% in less than two years! Hard to complain about that as a shareholder.

Capri’s buyback machine has shown no signs of stopping. Management even reiterated capital returns as a priority, despite the more challenging operating environment:

“We noted in my prepared remarks a net debt of $1.26 billion. And our leverage ratio is very solid and low. So we feel very comfortable with the strength of both our balance sheet and our cash flow, and we're using that to redeploy and purchase shares to return cash to shareholders.

So when we look at our capital allocation priorities, still number one, invest in the business; number two remains returning cash to shareholders, and then pay down debt, which we have done over time and managed very carefully.” -Thomas J Edwards CFO.

Ultimately, working off excess inventory should be a tailwind to cash flow over the next couple of years. I expect management to plow this additional cash flow right back into further share repurchases. Capri shares are currently trading at just 6.5 forward earnings and 7.5x forward EV/EBITDA. Capri isn’t just cheap on an absolute basis. It also trades at a discount to even low-quality retail names:

Updating my projections:

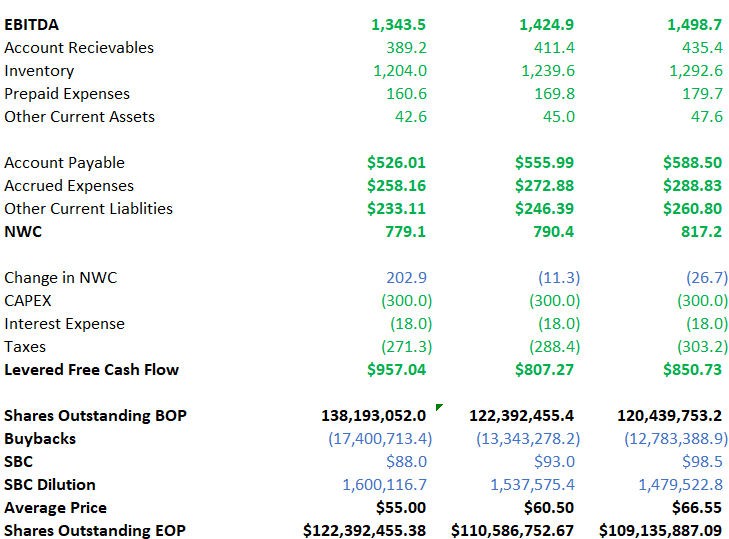

Given Capri’s new guidance and commentary, I decided to update my financial model:

For FY24, I modeled it in line with management’s guidance, if not slightly more conservatively. Like my original model, I forecasted Capri spending all of their levered free cash flow on repurchasing shares:

For FY25, I project a modest resumption of growth and operating leverage across the three brands, getting me an EPS of $7.18. Slap on a 14x multiple and you get a price target of $100, or ~150% upside from its current price. I’m going to continue holding my full position here.